Start Up Package Detail

| £30 pcm + VAT | Target Market: Sole Traders |

Ideal for contractors, consultants and professionals.

We take care of everything in a seamless and friendly way.

When you sign up to our service, you can relax knowing that your accounts are in experienced hands. Our team of accountants do all the hard work for you, streamlining your tax affairs and ensuring your tax return is completed to your advantage

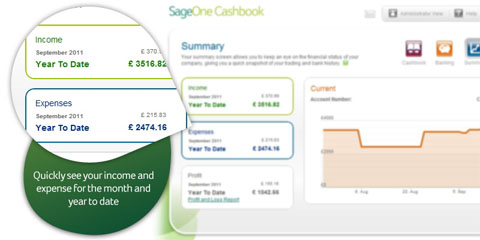

Free access to Sageone so you can view your accounts in real time from any where with an internet connection, no more need to chase your accountant. This enables you to get on with the important task of running your business.

Included is payroll for one director, company P35. Company annual accounts and CT600 to HMRC. Self assessment tax return one director/sole trader. Everything a small limited company or self employed person needs, including full telephone and email support.

Features

|  |

| 24/7 Access |

| Full Sage Support |

| Secure Online Filing |

| Sales Invoicing |

| Yearend Accounts (P&L and Balance Sheet) |

| Monthly Payroll, PAYE & Annual Return | 1 |

Monthly Payroll and PAYE will be provided for a single employee only |

| Transactions | 50 |

Only the first 50 sales transactions are included in the price, additional transaction bolt ons can be purchased |

| Bank Rec Stirling up to 2 accounts | Monthly |

Bank accounts will be fully reconciled each month end to provide management information. |

| Self Assessments | 1 |

Completion and filing of 1 Self Assessment to HMRC |

| Reports | Quarterly |

Profit & Loss, Accounts receivable statement, Accounts payable statement, Bank & Credit card reconciliation report, Any other customised reports will be quoted separately. |